Introduction

In today’s interconnected world, international travel has become more accessible and common than ever before. While embarking on a journey to explore new destinations or for business purposes is exciting, it also brings with it the potential for unforeseen medical emergencies. In such situations, access to quality medical care may not always be readily available. This is where Global Medical Evacuation Insurance (GMEI) plays a crucial role in providing peace of mind and safeguarding travelers against the unexpected.

-

What is Global Medical Evacuation Insurance?

Global Medical Evacuation Insurance is a specialized form of travel insurance that focuses on covering the costs associated with medical emergencies and necessary medical evacuations when traveling internationally. The policy ensures that policyholders receive timely and safe transportation to the nearest appropriate medical facility or back to their home country for adequate medical treatment in case of severe illness or injury.

-

The Benefits of Global Medical Evacuation Insurance

-

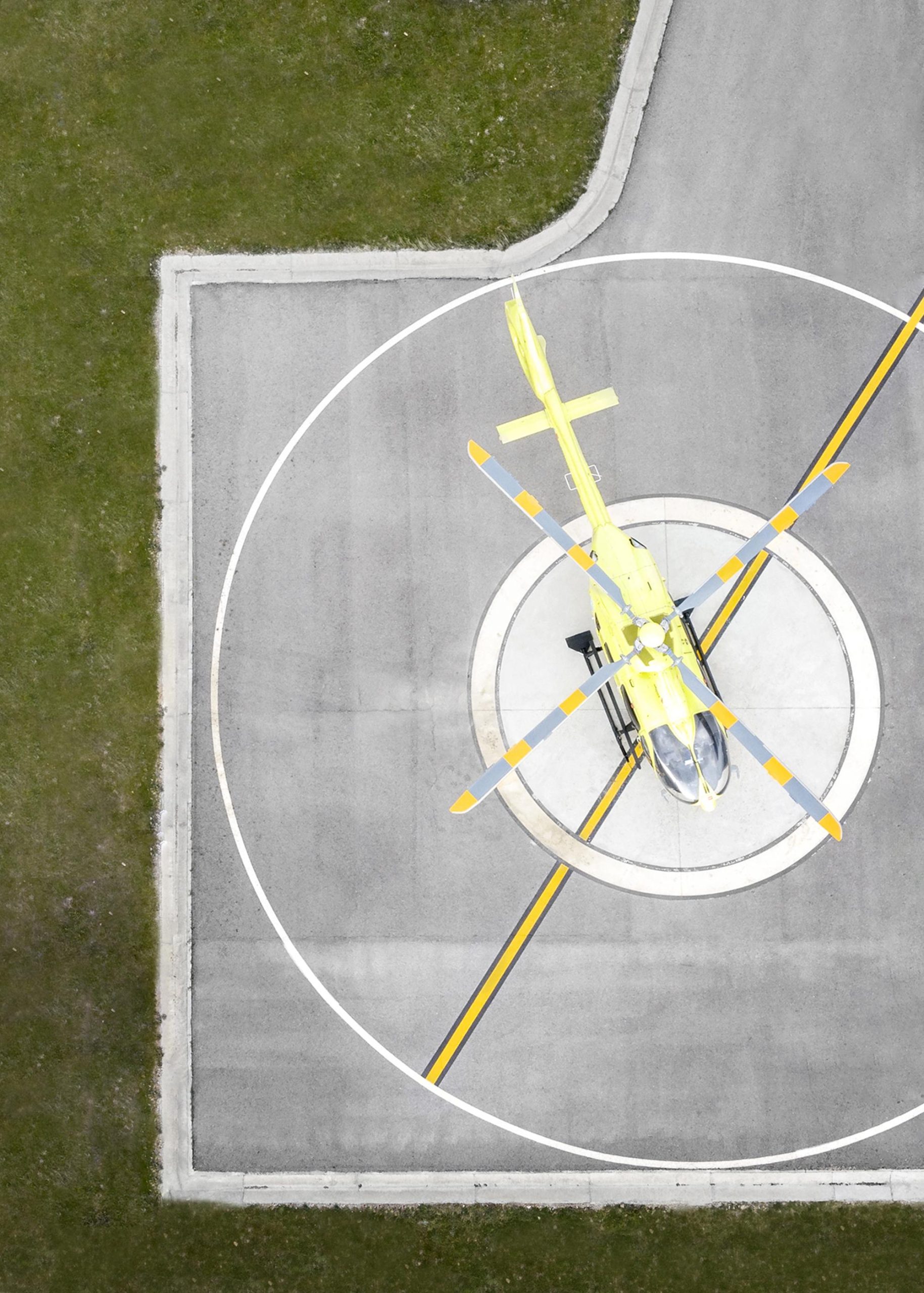

Medical Evacuation and Repatriation Services

One of the primary benefits of GMEI is access to professional medical evacuation and repatriation services. In the event of a medical emergency that requires specialized treatment unavailable at the current location, the insurance provider will arrange and cover the expenses for transporting the insured to the nearest suitable medical facility or back home, depending on the severity of the condition.

-

Peace of Mind and Security

Global Medical Evacuation Insurance offers peace of mind to travelers, knowing that they are protected in case of a medical crisis. This sense of security allows them to focus on their travel experience without worrying about the potential financial burden of an unexpected medical evacuation.

-

Emergency Medical Care Coverage

GMEI often covers the costs of emergency medical care and treatment at international locations. This coverage includes expenses for hospitalization, surgeries, prescription drugs, and other medical services required to stabilize the insured’s condition before the evacuation, ensuring immediate medical attention when needed.

-

Evacuation from Remote or Dangerous Locations

For travelers exploring remote or hazardous destinations, access to adequate medical facilities may be limited. Global Medical Evacuation Insurance provides an extra layer of protection by offering evacuation services from these challenging locations, where standard medical care  may not be readily available.

may not be readily available.

-

Travel Assistance Services

In addition to medical evacuation benefits, GMEI policies frequently offer travel assistance services. These services may include translation assistance, travel information, lost luggage support, and even legal aid, ensuring comprehensive support throughout the journey.

III. Coverage Limitations and Considerations

While Global Medical Evacuation Insurance offers extensive benefits, it is essential for travelers to understand the coverage limitations and factors to consider before purchasing a policy:

-

Pre-Existing Medical Conditions

Most GMEI policies do not cover pre-existing medical conditions. It is crucial for travelers to review the policy’s terms and conditions to understand what constitutes a pre-existing condition and how it might affect their coverage.

-

Coverage Regions

Travelers must be aware of the coverage regions specified in their GMEI policy. Some policies may have restrictions on specific countries or regions, so it is essential to ensure that the intended destinations are covered.

-

Trip Duration

Policies may have limitations on the duration of coverage for each trip. Travelers planning extended stays abroad should verify that their insurance provides adequate protection for the entire duration of their journey.

-

Maximum Coverage Limit

Global Medical Evacuation Insurance policies typically have a maximum coverage limit. Travelers should assess whether the limit is sufficient to cover potential medical expenses and evacuation costs in their chosen destination.

-

Adventure Sports and Activities

If travelers intend to participate in adventure sports or high-risk activities during their trip, they should inquire about the policy’s coverage for injuries resulting from such activities.

-

Understanding Policy Exclusions

To make informed decisions, travelers should be aware of common exclusions in Global Medical Evacuation Insurance policies:

-

War and Civil Unrest

Most policies exclude coverage for injuries or emergencies resulting from war, acts of terrorism, or civil unrest. This exclusion extends to locations that are under travel advisories issued by governmental authorities.

-

Self-Inflicted Injuries and Substance Abuse

Intentionally self-inflicted injuries and medical emergencies arising from substance abuse or alcohol-related incidents are generally not covered by GMEI policies.

-

High-Risk Destinations

Certain high-risk destinations, such as countries experiencing ongoing conflicts or natural disasters, may be excluded from coverage due to their volatile situations.

Conclusion

Global Medical Evacuation Insurance is a vital aspect of international travel planning, offering travelers a safety net in case of unforeseen medical emergencies. The benefits of GMEI, such as medical evacuation and repatriation services, emergency medical care coverage, and peace of mind, provide invaluable protection during international journeys. However, understanding policy limitations, coverage exclusions, and considering individual travel needs are equally essential when selecting the right insurance plan.

With comprehensive Global Medical Evacuation Insurance, travelers can embark on their adventures with confidence, knowing that they are well-prepared for any medical eventuality that may arise during their journeys. Don’t let unforeseen medical emergencies ruin your international travel experiences. Ensure your safety and peace of mind with Six Kind. Call us now at 1-866-939-5463 to secure your protection and embark on worry-free adventures. Contact us for comprehensive support throughout your journey, including travel assistance services.